Open a micro letter and sweep a two-dimensional code

Subscribe to our WeChat public number

Turn on the phone and sweep the two-dimensional code

You can access the website and share it with your friends through a mobile phone

Measures to Support the Upgrading of Regional Headquarters of Multinational Corporations in Shanghai (the “2025 Measures”) has come into effect on 1 March 2025. It is designed to support MNCs’ regional headquarters in Shanghai, focusing on expanding their headquarters' roles beyond regional coordination to include research and development, financial management, procurement, supply chain management, and shared services.

1►Incentive MNCs for upgrading and expanding their headquarters’ functions through financial grants

MNCs that upgrade their existing China regional headquarters to Asia-Pacific headquarters, while incorporating two or more core functions -- such as R&D and financial management -- are eligible for a one-time grant of RMB 3 million. Referencing to the 2022 “Provisions on Encouraging Multinational Corporations to Establish Regional Headquarters in Shanghai,” and its definition for “Global Business Unit Headquarters”, headquarters that fulfill its criteria may receive up to RMB 10 million in incentives, one of the most substantial financial support Shanghai has offered to a single corporate entity in recent years. In addition, headquarters may receive RMB 3 million per newly added core function (e.g., establishing an R&D innovation platform or a treasury center), subject to evaluation. Headquarters with R&D functions are also eligible to apply for accreditation as high-tech enterprises and benefit from preferential policies, such as a reduced corporate income tax rate of 15%, compared to the standard rate of 25%.

2►Enhance cross-border convenience

Cross-border Financial Management: To encourage headquarters to establish financial centers and set up cash pools, local banks will strive to optimize the functionality of free trade accounts to enhance cross-border payment efficiency, support automated cross-border payments, and offer preferential terms for margin, fees, and foreign exchange options.

Trade Facilitation: Eligible headquarters can qualify to be "Authorized Economic Operator" (AEO) credit cultivation priority enterprise list. Through the "1+N" group cultivation model, these companies are prioritized for AEO certification, enjoying AEO policy benefits. The 2025 Measures also propose exploring a mechanism for pre-determination of import goods pricing, aimed at reducing the risk of customs disputes, further enhancing trade facilitation.

Data Exchange: Eligible headquarters will be granted a green channel for cross-border data transmission.

Simplify employee's entry-exit: Headquarters personnel will benefit from streamlined applications for APEC Business Cards and talent visas for Hong Kong and Macau. Headquarters’ personnels stationed overseas may be granted multiple-entry, long-duration visas. Foreign talent employed by the headquarters will enjoy simplified processing for work and residence permits. In addition, accompanying family members will be granted equal entry and residence duration, with eligible family members of foreign senior executives also supported in applying for residency in Shanghai.

3►Analysis of combination of policies

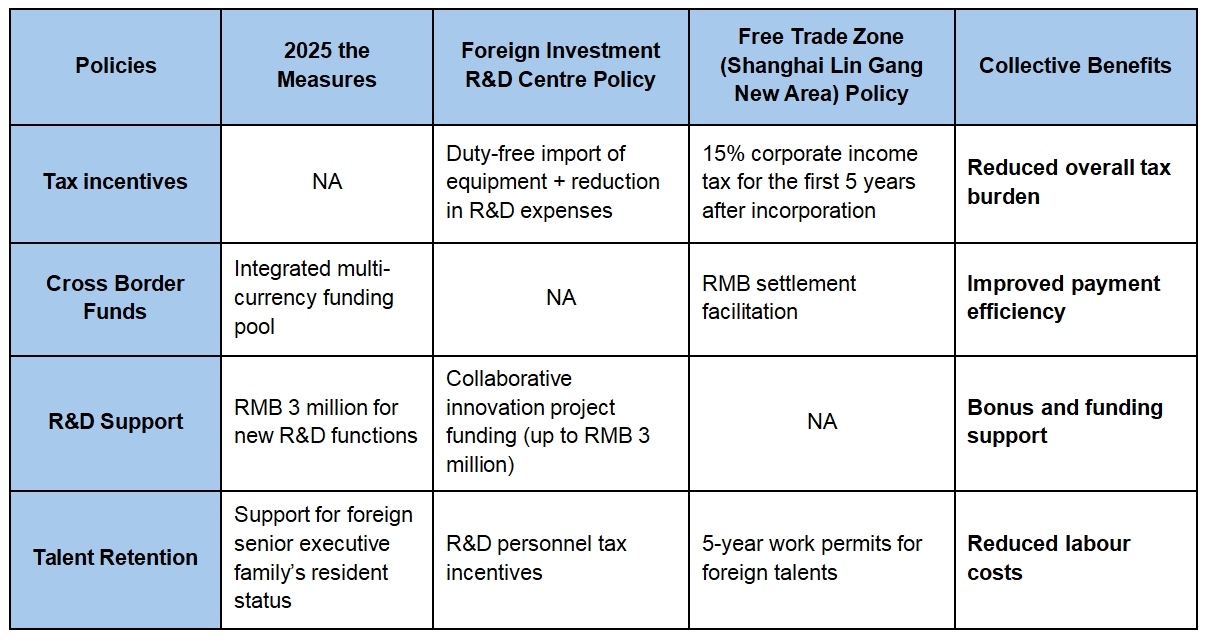

It is worth noting that the 2025 Measures can generate synergy when combined with existing policies. When paired with the policy on foreign-invested R&D centers, MNCs in key industries can enjoy both duty-free import of R&D equipment and incentives for upgrading their headquarters. In coordination with Shanghai Free Trade Zone policies, MNCs can also benefit from integrated RMB and foreign currency fund management, as well as streamlined offshore trade operations.

According to Fiscal and tax [2020] No. 38, “key industry enterprises” refer to those engaged in core segments of strategic sectors within the Shanghai Lin Gang New Area, such as artificial intelligence, biomedicine, and civil aviation. For example, a qualifying multinational pharmaceutical company (as illustrated in the table below) could establish a dual structure comprising a global R&D center and an Asia-Pacific headquarters, thereby benefiting from both additional R&D expense deductions and headquarters upgrading incentives.

Overview of Combined Policy Incentives for Qualifying Key Industry Enterprises:

The 2025 Measures, through a powerful combination of “substantial incentives + comprehensive facilitation,” once again underscore Shanghai’s ambition to become a premier global center for international business and headquarters operations. For MNCs, this represents not only a valuable opportunity to secure financial support, but also a strategic window to optimize their global footprint.

7F Wheelock Square, 1717 Nanjing West Road, Shanghai 200040, PRC

Zip Code:200040

Phone:+8621 61132988

Fax:61132913

Email:hr@mhplawyer.com